First Republic Bank, the most recent bank to fail in the US, is the second largest bank failure in US history. It comes after the failures in March and April of other large banks, Silicon Valley Bank and Signature Bank, as well as the forced merger of long-ailing Credit Suisse with UBS in Switzerland.

Why are these banks failing at this time? Are these bank failures the tip of a bigger iceberg looming, akin to bank failures in various parts of the globe in 2007 and 2008? Are the steps being taken by the authorities in the United States and Europe sufficient to stem the current string of failures, or do they open the gates to a new set of banking problems in the future. The goal of this article is to try to answer these questions, however it’s worth noting that to the extent that similar questions were posed in the early stages of past banking crises the answers at the time have not provided permanent solutions.

Banking crises usually evolve out of too much risk taking. In the lead up to banking problems during the Global Financial Crisis, US and European banks lent too much for housing in an environment where house prices had been bloated by many years of falling interest rates and easier borrowing conditions. Lending standards deteriorated with loans provided to borrowers with low capability to meet contractual debt servicing obligations. One hundred percent and more loan to home valuations became commonplace in the US in 2006 and 2007. A high-pressure sales mentality permeated US mortgage lending, with bankers richly rewarded for meeting escalating loan sales targets with increasingly scant regard for loan quality and basic tenets of prudent lending.

Banks around the world became involved in the ballooning US mortgage lending market, viewing the purchase of US mortgage- backed securities, perceived as low-risk securities, as a way to boost profits. Alongside other leveraged products, these assets were often given strong but undeserved credit ratings by ratings agencies. At the time, banks and other investors often borrowed short-term funds to invest in US mortgage-backed securities. Mortgage lending and leveraged securities issued in some European countries also became popular investments, but were similarly providing, unrecognised, totally inadequate return for the escalating underlying credit risk as well as the increasing difficulty selling these securities in secondary markets.

As the poor home lending practices in the US turned to defaults and collapsing house prices, the previously unrecognised high and mounting risks in mortgage lending were laid bare. Banks and investors rushed to sell, causing a rapid liquidity collapse in secondary market trading. Failures of security firms (the most notorious, Lehman Brothers, thought by many to be too big to fail) and many banks caused bank depositors around the world to try and withdraw funds.

Facing a global financial panic that had effectively seized-up banking systems and threatened to tip the world in to a deep economic depression, the world’s central banks and banking regulators had to act quickly to restore liquidity and confidence to the world’s banks. Central banks reduced interest rates quickly and increased, sharply, their lending to banks at low interest rates. They also reinforced their lending at low interest by buying securities from banks (quantitative easing) flooding the world with liquidity. Relatively stronger financial institutions were allowed to absorb weaker financial institutions at fire-sale prices. Governments boosted their spending and borrowings to shore up economies in the aftermath of the financial crisis, even governments in Europe where budget deficits for some were perilously large.

The legacy of the global financial crisis and the policy reactions of the central banks and governments after is a mixed one. On the positive side, a global economic depression was avoided and banking prudential standards – safe lending requirements and capital adequacy – were improved in the US in particular.

On the negative side, government spending and borrowing quickly triggered sovereign debt issues in Europe and a need to restrain budget spending at a time when some European economies were still experiencing protracted weak economic growth. Extremely low central bank official interest rates, below zero, for a prolonged period in Europe, complicated attracting deposits and compromised ability to lend at a profit. Europe was beset for a period by both unwilling borrowers and lenders and extended poor banking profitability – essentially a cause of the problems faced by Credit Suisse and of investor concerns currently about some European banks.

Sometimes the best-intentioned solutions to a banking crisis sow the seeds for the next crisis. Bailing out banks when they get into difficulty, whether by injecting funds or buying their assets, while deemed essential at the time of crisis, leaves in its wake an institution less willing to lend and only able to attract deposits at a premium. The bailed- out bank’s interest earning margin and profitability are compromised, increasing the risk that it becomes a bank unable to recover fully and at times needing to reduce lending because of persistently weak or even falling growth in deposits.

Bailouts can also send an inappropriate message to bank shareholders and bank management that if a bank takes risks that result in insolvency, ultimately the public purse will pick up the cost. Bailouts may add to the risk of a credit crunch, worsening a banking crisis while furthering reckless banking behaviour beyond the current problems that lead to excessive risk taking. This in turn could cause banks to take too many risks, which would lead to the next banking crisis.

Turning to another legacy issue from the solution to the global financial crisis, the lengthy period of very low official interest rates, combined with quantitative easing, caused banks to be more reluctant to lend and more likely to prefer seemingly safe assets such as government bonds. The resulting tight credit conditions kept economic growth and inflation relatively low. These economic conditions made it difficult for central banks to even start to consider returning monetary policy settings to what might be considered normal settings.

Few central banks had even started the process when the pandemic arrived in early 2020, with its early-stage quarantining measures causing a sharp reduction in economic growth. Governments responded with sharply increased spending aimed largely at supporting household and business incomes. Central banks responded by doubling down with low interest rates that saw government bond yields fall to near zero and below in Europe.

The combination of massive government spending and very low interest rates boosted household spending sharply, but in a world where lockdowns had caused restricted supply of goods and services and supply chain problems that would take time to resolve. Far too much pent-up demand once pandemic restrictions eased chasing too little supply caused prices to rise and at the fastest pace since the 1980s. The war in Ukraine added another constraint on supply of food and energy commodities. Central banks were blind-sided by the speed and extent of the pick-up in inflation and were left needing to hike interest rates urgently and substantially through 2022 and early 2023.

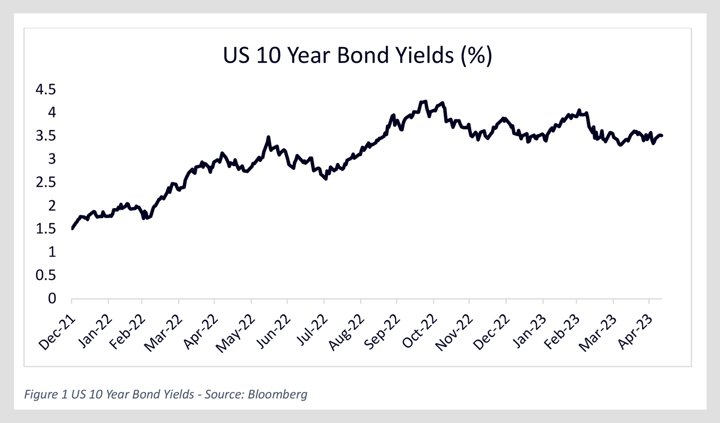

The US Federal Reserve hiked its funds rate from near zero to currently 5.25% after the most recent 25 basis point hike in early May. US government bonds had their worst year in history in 2022. The 10-year bond-yield lifted 200 basis points from 1.51% at the end of 2021 to 3.51% by the end of 2022 (Figure 1) while the 1-year bond yield lifted more than 450 basis points from near zero to 4.66%. It has risen above 5.00% since.

The historic rise in US bond yields meant that the “safe” low-risk government bond holdings on US banks’ balance sheets, accumulated with very low coupon yields in the earlier years of exceptionally low interest rates, became very high-risk in the much higher interest rate environment of 2022 and early 2023. Rising interest rates meant the value of bonds, if they needed to be sold, were much lower than the purchase price recoded in banks’ assets. Long-term fixed rate mortgage loans on the banks’ books were also worth less if marked-to-market valuation. US banks are not obliged to mark-to-market their assets in their quarterly financial statements, but from mid-2022 the extent of interest rate increases made it clear that many banks were sitting on substantial unrealised losses if their assets were marked-to-market.

On some estimates, these unrealised losses on around $US4 trillion of US bank assets have run up to around half of their core regulatory equity safety cushions, although the pattern of losses is varied with some, mostly the big US banks, showing comparatively small unrealised losses, while a few have all but wiped out their equity safety cushions.

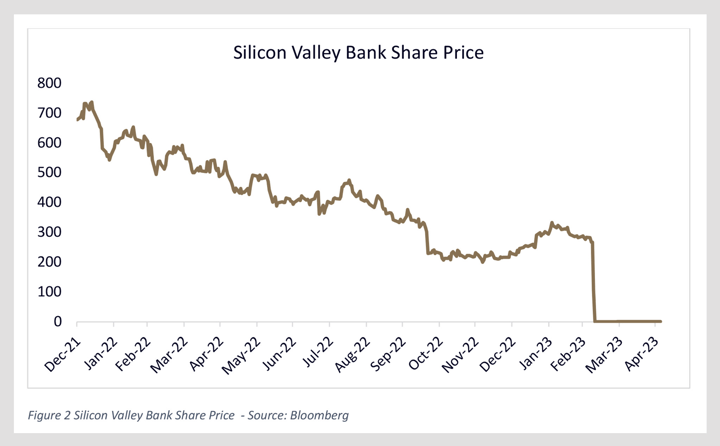

Concern about US banking problems caused depositors to move their funds out of banks deemed most at risk, mostly regional banks, which then forced those banks to try and cover deposit losses by seeking more expensive short-term funding and in some cases to sell assets at a loss. In March, an early regional but relatively big bank failure in the current bout of US banking troubles was Silicon Valley Bank, where unrealised losses on government bond holding had all but eliminated its regulatory equity buffer, triggering depositor panic and a rush to close deposits.

Silicon Valley Bank, a Californian regional bank focussing on business opportunities in Silicon Valley, was unusual in that it had an exceptionally large proportion of deposits above the $US250,000 maximum threshold for deposit insurance by the Federal Deposit Insurance Corporation. More than 80% of its deposits were above the FDIC threshold and uninsured, a factor that added to the quick escalation of loss of deposits and cheapest source of funding. As depositors rushed to withdraw, a rapid reduction in share value (Figure 2) and looming insolvency forced SVB to shut its doors, adding to the pressure elsewhere as investors and bank depositors to looked for signs of stress in other US regional banks.

One positive development in the current round of US banking troubles is that the deposits moving out of troubled banks in part found a new home in some of the biggest banks in America that were seen to be still profitable and safe. The flight of deposits to the biggest banks has added to their profitability in the near term, with more relatively cheap deposit funding serving to improve interest earning margins.

Differences are becoming clear between the current troubles in the US banking system and what occurred during the global financial crisis. In the global financial crisis, the main problem was widespread excessive lending risk, widespread defaults and a liquidity crunch that affected all banks and financial institutions. In contrast, excessive lending is not yet evident in the current US banking problems, although this assessment could change if the US economy suffers recession turning a rising proportion of previously safe loans to becoming non-performing or at risk of default.

Essentially, the current banking problems have been generated by interest rates rising much faster than expected, leaving some bank asset values reduced on mark-to-market valuation. Some banks are much less affected than others and a few have come through apparently more profitable than before, mostly the biggest banks. At this stage, while there are many more regional banks that may be at risk, the biggest banks in the US are not at risk.

The response of the authorities has been the usual one of providing funding to the banks in acute difficulty. After the failure of Silicon Valley Bank policy makers effectively promised that all deposits were safe.

The latest bank needing rescue, First Republic Bank, could not be restored by either emergency funding from the Federal Reserve on generous terms amounting to $US93 billion or the promise that all deposits are safe. Ultimately, First Republic Bank, was saved by being bought by a strong, profitable big US bank; J P Morgan.

The option of big, profitable US banks buying smaller distressed banks remains. This was not an option in the global financial crisis when all US banks were suffering impaired assets and depositor confidence was low in all banks.

Also, the cause of the current round of US banking problems, rapid and largely unexpected rising interest rates, may be starting to resolve. It seems likely that the worst of the big increases in US interest rates is behind us. While the Federal Reserve may need to hike a little further to contain inflation, the US bond market is looking ahead to the weaker US growth that flows from high interest rates setting the scene for when the Federal Reserve can start cutting official interest rates. Longer-term government bond yields and longer-term fixed rate mortgage interest rates have fallen from their peaks earlier this year. The move lower in longer term interest rates may suffer occasional set-back but the trend running through the undulations is downwards. That means that interest-rate related US banks’ unrealised losses on lending and bond assets are starting to fall.

The current round of US banking problems may still have further to go as investors and depositors seek out reasons for concern. The measures taken by the authorities providing funding and back-stopping the value of banking assets, as well as promising that all depositors are safe, go some way to restoring confidence, but come with the risk of leaving weakened banks operating, a source of an intensifying credit crunch near-term and sowing the seeds of imprudent banking practice down the track. Mergers between stronger banks and weaker banks are a viable solution in the current crisis and addresses the risks in authorities’ responses to date.